EMPLOYERS RESPONSIBLE FOR WC BENEFITS.

Not all employers are responsible for providing WC benefits. Only employers with 4 or more employees are required to provide WC benefits; however, employers considered to be engaged in the construction industry are required to provide WC benefits if they employ 1 or more employees.

COMPENSABLE ACCIDENT OR INJURY.

The WC Law is considered to be a “no-fault” law. It is not necessary to prove that the employer was negligent or otherwise “at fault” in causing your injury. Because the WC law imposes liability for work-related injuries without regard to fault, the WC law protects the employer from any other liability that the employer may have to the injured employee. In other words, you may not sue your employer for damages because you can prove that the employer was at fault for causing your injury. A compensable injury is considered to be any injury that occurs by “an accident arising out of and in the course of the employment”. Under this definition, it is not necessary to prove that the injury was the result of a slip, trip, or fall. For example, back injuries resulting from lifting activities are usually covered. WC benefits are denied if the injury is the result of illicit use of drugs or alcohol or if the employee tests positive for drugs or alcohol following an accidental injury. WC benefits may also be denied if the injured employee has engaged in activities related to his or her claim that is considered to be “fraudulent” and include giving false information to the employer or its insurance carrier concerning any material matter concerning the injury or accident. Employees who have misrepresented their medical history or prior receipt of disability compensation on an employment application may be denied compensation for a subsequent injury.

DISABILITY COMPENSATION.

Disability compensation has based on a portion of your average weekly wages (AWW) at the time of your accident. It is important to understand that the WC Law is not intended to compensate you for 100% of your lost wages or earnings that may be the result of your accident. Your AWW is based on your earnings, including overtime and bonuses, earned over the 13 weeks preceding your accident.

MEDICAL TREATMENT.

The employer/carrier has an obligation to provide all medically necessary treatment for your injuries. HOWEVER, YOUR RIGHT TO SELECT THE DOCTOR WHO TREATS YOU IS VERY LIMITED AND IS LARGELY CONTROLLED BY THE EMPLOYER OR ITS INSURANCE CARRIER. You have the right to make ONE change of physician after an employer-authorized physician has initiated treatment. Upon reaching maximum medical improvement, you will be obligated to pay a co-payment of $10 per visit for medical services.

TIME LIMIT ON CLAIMS.

If you have not been paid or provided benefits to which you believe you are entitled, you must file a claim (called a petition for benefits) within 2 years after the date on which you knew or should have known that the injury arose out of work performed in the course of your employment. The payment of benefits or receipt of authorized medical care and treatment tolls the 2-year period for 1 year from the date of such payment.

CLAIMS FOR COMPENSATION BENEFITS.

An injured employee’s only responsibility upon being injured is to promptly report the accidental injury to the employer. By law, the accidental injury must be reported within 30 days of its occurrence. All disability and medical benefits are supposed to be provided without the necessity of taking legal action by filing a claim. It is only when benefits have not been provided as and when due that a claim. Your entitlement to the benefits claimed is determined by a non-jury trial before a Judge of Compensation Claims.

ATTORNEY FEES.

The amount of the fee is based on 20% of the first $5,000 of benefits recovered, 15% of the next $5,000, and 10% of benefits recovered in excess of $10,000. The employer must pay the fees if you have to file a claim to get benefits that the employer has denied.

SETTLEMENTS.

The judge must approve any lump-sum settlement made if you are not represented by an attorney. If you are represented by an attorney, a settlement may be made at any time without the approval of the judge of compensation claims, except that the judge must approve any attorney fees paid pursuant to the settlement. Some or all of the settlement funds may be required to satisfy any child support arrearage in any case where the employee has been ordered to pay child support through a court or other state agency.

Practice Areas

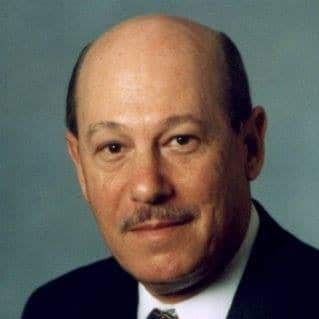

Why You Are in Good Hands With Attorney Barry Salzman:

Frequently Asked Questions

You will benefit from expert assistance for determining if you are being provided with all the benefits you are entitled to. Your lawyer will assist you in prosecuting claims for benefit that have wrongfully been denied.

You must report your injury to your employer within 30 days of the injury. You must file any claims arising out of the injury within 2 years of the injury or within 1 year of the last date that any WC compensation or medical treatment was provided by the employer.

Yes, over 50 years as a practicing lawyer and former WC judge.

Yes.

Yes, to/from authroized medical treatment and pharmacies.

You may file a Petition for Benefits (claim) with the Office of the Judges of Compensation Claims. Thereafter a mediation conference will be scheduled with the employer or its WC insurance carrier. If the meediation fails to resolve the claim, a hearing will be scheduled with a Judge of Compensation Claims.

Schedule Your Consultation Today

Navigating the bureaucracy of any disability program is complex and frustrating and often ends in denial.

Don't do it alone! Have a dedicated, experienced advocate on your team.

Fill out the form below or give us a call at 727-321-4993.