Through ERISA (Employee Retirement Income Security Act), Congress intended to protect such things as employee pensions, life insurance benefits, disability insurance benefits, health benefits, and the like. If these benefits are obtained through a “Plan” created by an employer or an employee organization (like a labor union), then, with some exceptions, ERISA applies. This means that federal law–ERISA–governs whether a worker is entitled to the benefits, what rights the worker has to obtain information, and what remedies the worker has if his (or her) claim for benefits is denied.

It is difficult to overstate the impact of ERISA application. ERISA sweeps away state laws that would normally govern whether there was a right to benefits. ERISA replaces these state laws with a comprehensive set of Federal regulations. State laws involving breach of the insurance contract and bad faith do not apply to ERISA plans.

ERISA governs all claims for benefits (whether procured through insurance or otherwise) from an “employee welfare benefit plan.” An employee welfare benefit plan is defined as “any plan, fund, or program . . . established or maintained by an employer or by an employee organization” which provides employee benefits such as life, health, or disability. 29 U.S.C. § 1002(1). If your right to benefits is through a plan established by an employer or an employee organization (like a labor union), it is preempted by ERISA.

State Law vs. ERISA

Why is it so important to determine whether your claim is subject to ERISA? Because ERISA preempts normal state court remedies with its own enforcement scheme. Compared to state court remedies, the federal enforcement scheme is sadly lacking and “stacks the deck” in favor of the employer and its insurance carrier.

ERISA remedies are substantially different than what is seen under most state laws, for example:

Almost all employee benefit plans grant the plan administrator and the plan fiduciary wide discretion in the interpretation of the plan and in the determination of benefits owed. Where such discretion is granted in the plan, the federal judge cannot make his/her own independent determination of whether benefits are due; instead, the judge is limited to reviewing the action of the plan administrator or fiduciary in denying benefits and may not overturn that decision unless the decision can be found to be arbitrary and capricious.

So What Does All This Mean if My Claim Is Denied?

I’ll make this simple…you need a lawyer! Remember, if the evidence that supports your claim is not presented to the plan administrator before its final denial of your claim, you may not be able to get that evidence before the federal judge if you later have to file suit to overturn a final denial of benefits. Oftentimes the assistance and cooperation of your physicians may be necessary, or you may need evaluations by other specialists. Sometimes it is necessary to have vocational experts address the impact of your conditions on your ability to perform the requirements of your job or other work. Most ERISA plans provide for a generous appeal period, normally 180 days. You must exhaust the appeal process provided for in the plan. Failure to do so may prevent you from filing suit in federal court. You cannot expect much assistance if you contact your lawyer a few days before the appeal period runs out. Do not delay contacting your attorney!

Practice Areas

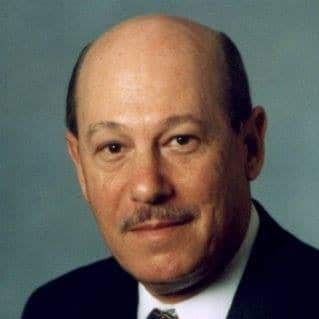

Why You Are in Good Hands With Attorney Barry Salzman:

Frequently Asked Questions

I have handled these cases for over 20 years.

Not necessarily, but fee arrangements depend on the specifics of the case.

LTD claims typically do not extend beyond age 65 or other retirement age. LTD claims based on mental disorders are far more limited--usually no more than 2-5 years.

Typically, claims are not allowed for substance abuse; otherwise, any physical or mental disorder that caused disability will be consdiered. Private policy claims must arise while the insurance was in force; employer plans require that your condition arise while an active employee.

No, it's the other way around. Social security disability benefits will usually reduce the level of LTD benefits.

What Our Clients Say

Schedule Your Consultation Today

Navigating the bureaucracy of any disability program is complex and frustrating and often ends in denial.

Don't do it alone! Have a dedicated, experienced advocate on your team.

Fill out the form below or give us a call at 727-321-4993.